What impact can the coronavirus have on the valuation of commercial real estate?

Having hit almost all areas of the Czech economy, the COVID-19 pandemic is, without doubt, one of the main and hottest topics. Having paralysed business activity, put the lid on a number of manufacturing plants, stopped tourism, and shut down restaurants and hotels, it has inevitably also affected the property market. Further developments in the areas in question depend mainly on the rescue measures taken by both the national government and by the governments of all the states our economy is tied to. What matters is the duration of the current economic hibernation; the longer it lasts, the greater the impacts and the longer the subsequent period of economic recovery. The coronavirus is likely to lead to increased unemployment and decreased purchasing power across the population. At the same time, our economy is strongly influenced by developments in our main trading partner countries, in particular, in Germany.

As regards commercial real estate, the attitude of individual investors will be of importance. The commercial market, dominated by foreign investors, may be influenced by an outflow of these investors in the event of difficulties in their home countries. The impact of the coronavirus pandemic on commercial real estate is highly individual and is mainly related to the structure of the current tenant in terms of income stability, operational resilience, and occupancy rate. In these terms, a portfolio consisting of international corporations appears to be ideal. The biggest risks are faced by owners who offer short-term leases or those negotiating the conclusion or renewal of lease agreements. The commercial real estate that is most affected by the coronavirus pandemic includes hotels and shopping centres, which are physically shut down or only operating on a limited scale, and industrial facilities linked to the automotive sector, which found itself in a difficult position even before the outbreak of the pandemic. It will therefore be important in the long run for companies and real estate owners to be prepared and able to respond effectively in the event of the occurrence of a similar situation. A number of tenants will wish to cover these circumstances in their future lease agreements.

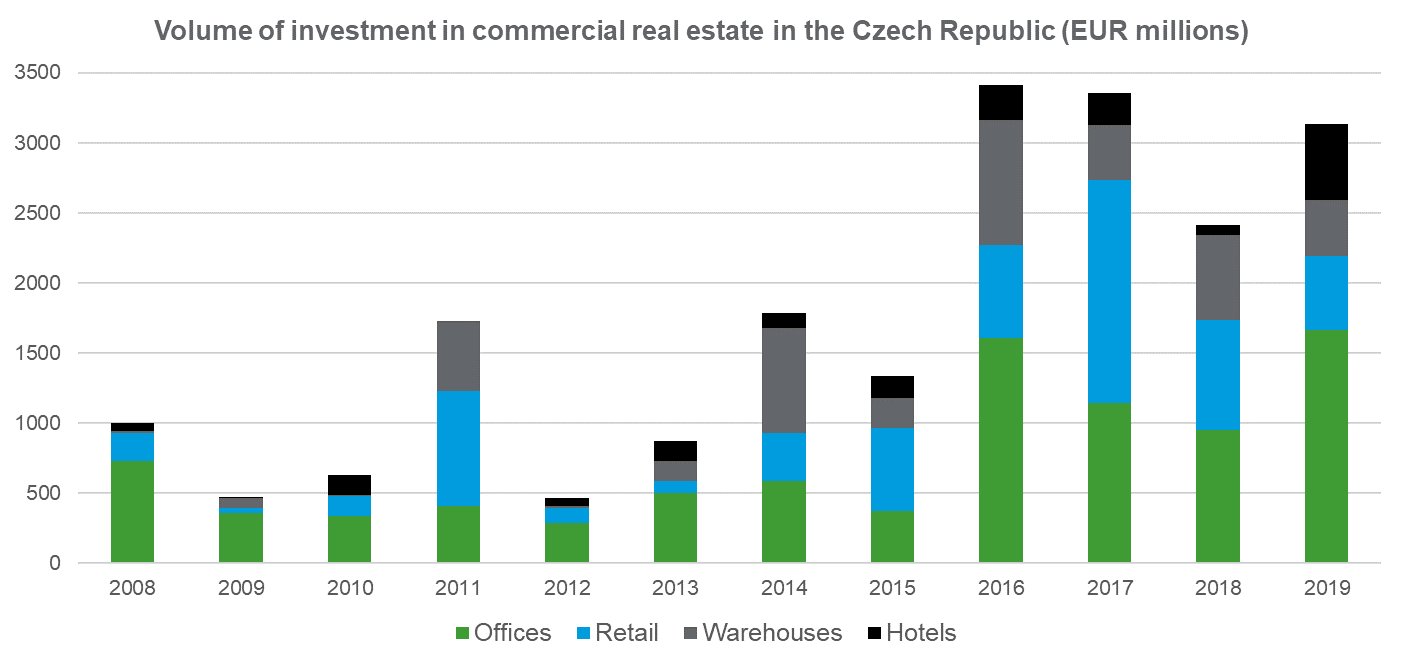

In connection with the current situation, it is helpful to recall the previous financial crisis of 2008, although that crisis originated directly on the real estate market rather than as a result of the intervention of “force majeure”. The banking sector is healthier, companies have greater capital strength, and unemployment is at a record low. On the other hand, it is difficult to estimate the impact of the closing of the borders on shops and large production plants. The financial crisis of 2008 had a major impact on the commercial property market. Most international investment funds left the Czech real estate market and the total volume of transactions in real estate dropped by about 62% during 2008.

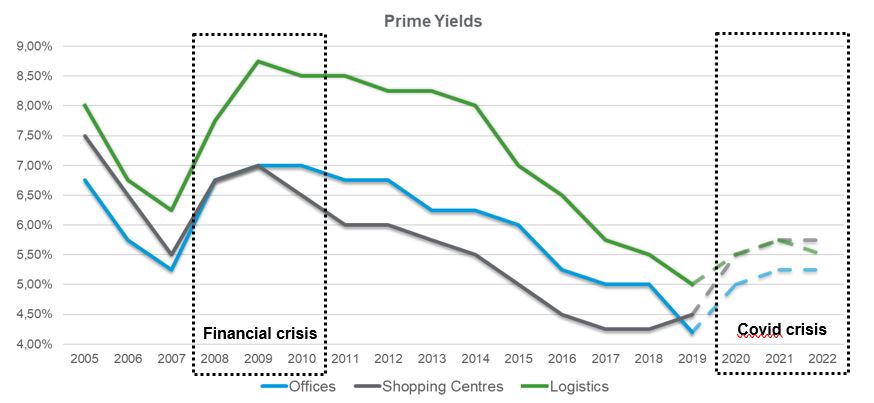

The text below provides our summary of the potential impacts of the coronavirus pandemic on the individual commercial real estate segments. We have focused on one of the likely scenarios of the development of the rates of return on premium real estate in a premium location with the best tenant structure (Prime Yields), which are crucial in terms of the valuation of real estate and which should reflect the impacts of this new pandemic crisis (the Covid Crisis). Real estate outside the sector of premium assets will be exposed to these risks to a greater extent than before the Covid Crisis. We also expect greater differences in the rate of return within the individual commercial property segments as the specific parameters of each property (location, technical condition, tenant structure) will be more important than they were before. Even though it is not easy for real estate experts to estimate the current rates of return for specific properties at this moment, or in the coming months, and as the foreseen low number of new transactions prevents this rate from being even implicitly derived, we will attempt to outline the likely development of Prime Yields with regard to the impacts of the previous economic crisis of 2008 and 2009 (the Financial Crisis).

It is clear that, in the initial phase of the Covid Crisis, corrections will take place mainly in terms of cash flow modelling, i.e. in terms of the revenues and costs associated with the ownership and leasing of real estate. Real estate owners will start negotiating with tenants over new rent rates, rent holidays, and other incentives; at the same time, costs will rise in connection with the higher vacancy rates, new costs associated with the disinfection of the premises will emerge, etc. All these new negative effects will have a bearing on real estate valuation more or less immediately in relation to the updated financial plans of real estate owners. Corrections of Prime Yields and, as applicable, of the corresponding rates of return on individual assets, will take place gradually over a year or two, depending on the development of the Covid Crisis and any follow-up problems there may be. Rather than assessing the impact on the value of real estate caused by a temporary or more permanent drop in revenues, which will be highly individual and will also harm the value of real estate, we only assess as part of our considerations the impact of the investors’ requirements for higher returns on their investments associated with the increased risks in the form of the parameters of Prime Yields .

Hotels

As far as the hotel market is concerned, the measures taken have led to an immediate drop in occupancy rates. This extraordinary situation has forced many hotel operators to lay off a part of their staff. The biggest risks are faced by hotels that focus on foreign clients; these are likely to take several years to return to their pre-Covid figures. If the restrictive measures that have been adopted are relaxed, the situation could improve for hotel operators in attractive tourist destinations, depending on the possibility or impossibility of international travel for holidays.

Retail

Negative impacts on the retail market can be expected with regard to the current shut-down or only limited retail operations, as well as in connection with the approved three-month postponement of rent, payable by the end of the year, which will mainly affect the property’s cash flow. The retail market is also affected by outages in the supply chain. The future shape of the retail market will also be influenced by the shift of customers towards the world of e-commerce, accelerated by the measures adopted in connection with shop closures. Many customers have tried online shopping for the first time and this trend can gain in strength, affecting future retail space occupancy. A significant decline caused by the outflow of foreign tourists can be expected in the case of retail spaces selling luxury goods on main shopping streets.

The development of the Prime Yields of shopping centres showed a 1.5% increase over two years during the Financial Crisis. Since that, since the turn of 2009/2010, there has been a gradual decline, with the exception of the last reporting year, 2019, which showed a year-to-year increase of 25 bps with Prime Yields around 4.50%.

The future development of the Prime Yields of shopping centres can be significantly affected by further negotiations regarding rent deferral and the related government aid, as these losses are also expected to be borne by real estate owners. As regards the further development of Prime Yields, we expect the curve to partially follow the year-to-year changes recorded during the Financial Crisis. From our point of view, the pressure on growth may tend to reduce the trend of shopping centres paying more attention to gastronomy and leisure in recent years.

Office

In the long term, the office market can be affected by a number of companies’ current findings that their employees can use the home office working modality effectively. This effect can lead to the optimisation of the utilisation of office space and promote the office sharing trend in the form of co-working centres, which are fundamentally affected by the current situation. Office space rent rates are currently at a record high and can be expected to drop as a result of the effects brought about by the Covid Crisis.

During the Financial Crisis, the office real estate market also slowed down and while the demand for new offices was stable, it was not high enough to cover the supply side fully. Prime Yields increased by 175 bps between 2007 and 2009. After 2010, there was a gradual decrease to the level of 4.20% at the end of 2019.

As regards the impact of the Covid Crisis on Prime Yields, we expect an increase to 5.0% by the end of 2020, i.e. the level at which the Prime Yields stabilised between 2016 and 2018. By the end of 2021, we expect only a slight increase of about 25 bps caused by the potential outflow of capital which has been invested in office real estate to a significant degree in recent years. After that we expect a gradual stabilisation and return to the pre-Covid figures.

Industry and logistics

The aspect of the tenant and, specifically, the tenant’s line of business is even more important in terms of the industrial and logistics market. The potentially negative impact of the Covid Crisis may be mitigated by the long-term lease agreements concluded with regard to most of these properties. It is also necessary to distinguish between property used for manufacturing and that used for logistics. In the case of logistics, the current situation has led to an increase in demand, caused by the surge in e-commerce. Demand from retail chain stores has also increased in the short term, driven by the need to expand the warehousing capacity for food and consumer goods. The manufacturing portfolio is crucial for manufacturing-related real estate. Portfolios related to healthcare face the lowest risks in the current situation. On the other hand, the current situation is likely to have a severe impact on the automotive sector and the related supply chains. In addition, the manufacturing portfolios can also be affected by outages in the global supply chains resulting from the current situation. In the long run, this situation may lead to increased demand driven by the goal of supply chain diversification.

During the Financial Crisis, the logistics market took the hardest hit because of its close association with the automotive sector and the decline in imports and exports of goods as a result of the drop in the performance of key European countries. This situation led to a complete standstill in the speculative construction of real estate for logistics. Prime Yields increased by 250 bps between 2007 and 2009. After 2010, there was again a gradual decrease, reaching 5.00% at the end of 2019.

During the previous Financial Crisis, the Prime Yields on this real estate were affected significantly; because of the minimal speculative construction and the development of e-commerce, we now expect them to increase only slightly to the level of 2017 and 2018.

Historical and forecast development of Prime Yields

The development of Prime Yields in the individual commercial real estate segments in the Czech Republic in 2005-2019 and their expected development in the coming years are shown in the chart below.

Specific example

How does the development of Prime Yields affect the value of real estate? As mentioned above, the Prime Yields from real estate for logistics increased by 2.5% between 2007 and 2009 as a result of the Financial Crisis of 2008. For the sake of simplicity, if the annual operating profit on a property was CZK 30 million, the 2007 value of the property would be CZK 480 million. Given a similar level of operating profit, its value would have decreased to CZK 343 million by 2009. An increase by the yield rate of 2.5% would thus mean a drop in value by 30% in this case, i.e. a decrease of about CZK 137 million. In 2019, the same operating profit would correspond to real estate with the value of around CZK 600 million and, if the market develops as outlined, the value of the real estate at the end of 2021 could be around CZK 522 million. A 0.75% increase in the yield rate would thus mean a decrease in the value of the property of 13%, i.e. about CZK 78 million.

Investment in commercial real estate

The chart below shows how the crisis would affect investments in commercial real estate in the Czech Republic. We can say that investors in the commercial real estate market were very cautious between 2008 and 2015 and the turning point came as late as 2016, which saw an increase in the investment volumes across all the sectors in question by over 200% in year-to-year terms.

What can we do for you?

Whatever your need for valuation in this situation, we will be happy to discuss the issue with you. The RSM CZ expert institute provides a wide range of real estate valuation services.