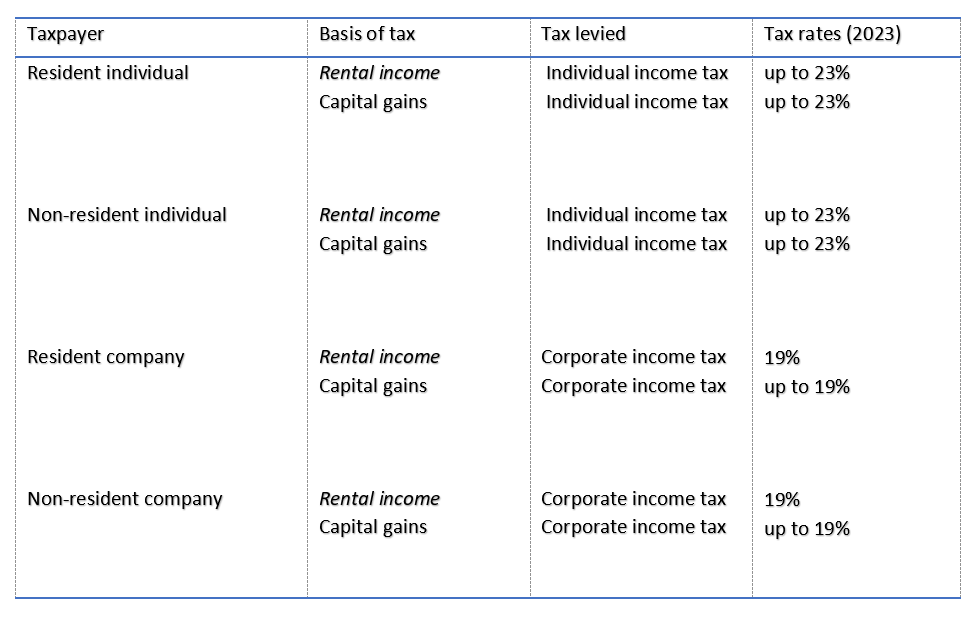

Rental income and capital gains of Czech real estate

Rental income

Individuals

Introduction

Rental income is taxed as part of a taxpayer’s annual income.

Liability to tax

Rental income received by individuals is subject to income tax of 15% or 23%. The rate of 15% applies to the tax base up to 48 times the average annual wage (i.e. up to CZK 1,935,552 in 2023). The rate of 23% applies to the tax base above this limit.

Basis to tax

The tax base is calculated as rental income (excluding occasional rent of movable assets) reduced by the deductible expenses. Expenses can be determined either as actually spent expenses or as 30% of gross income as lump-sum expenses but no more than CZK 600,000. A detailed overview of the taxation of rental income can be found in the chapter “Holding Czech real estate”.

Companies

Introduction

Rental income is taxed as a business income.

Liability to tax

Rental income is subject to 19% corporate income tax.

Basis to tax

Tax base is equal the difference between the business income and related expenses. A detailed overview of the taxation of rental income can be found in the chapter “Holding Czech real estate”.

Capital gains

Individuals

Introduction

Capital gains are taxed as part of a taxpayer’s annual income.

Liability to tax

Generally, the gains from the sale of real estate and gains from the sale of shares received by individuals are subject to income tax of 15% or 23%. However, the gains may also be exempt if the special conditions of the law are met.

Basis of tax

The tax base is generally equal the difference between the sale price and the acquisition costs. A detailed overview of the taxation of capital gains can be found in the chapter “Selling and transferring Czech real estate”.

Companies

Introduction

Capital gains are taxed as business income.

Liability to tax

Capital gains are subject to 19% corporate income tax unless the conditions for tax exemption in accordance with EU Parent – Subsidiarity Directive are met.

Basis of tax

Subject to corporate income tax is difference between the business income and related expenses. A detailed overview of the taxation of capital gains can be found in the chapter “Selling and transferring Czech real estate”.

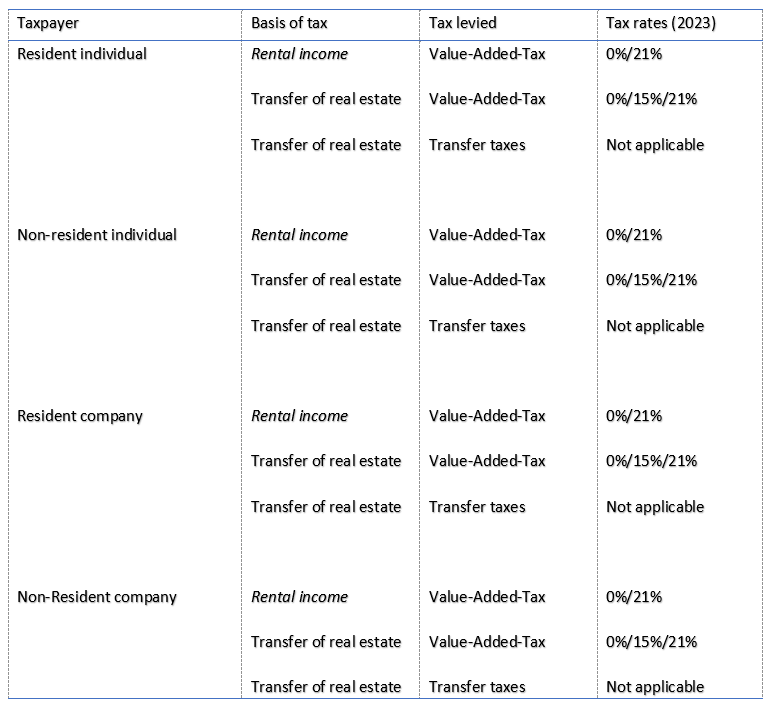

Czech VAT & transfer taxes

Value Added Tax

Introduction

Value added tax (VAT) is based on the increase in the value of a product or a service at each stage of the supply chain.

Rental income

Individuals

Liability to tax

Rental income is subject to Czech VAT if the rented property is located in the Czech Republic.

Basis of tax

Generally, income from the rent of real estate is exempt from VAT, excluding the following cases:

- short-term rent of real estate (lasting up to 48 hours);

- provision of accommodation services;

- rental of premises and parking places for vehicles;

- rental of safe deposit boxes; or

- rent of fixed equipment.

However, the lessor can opt for a VAT-able supply of the property (in case of rent to another VAT taxpayer for VAT purposes). The applicable tax rate is 21%. As of 1 January 2021, this option is not applicable in case of rent of real estate properties serving mainly for residential purposes.

Companies

The same rules as for individuals apply.

Transfer of real estate

Individuals

Liability to tax

A sale of real estate is in principle VAT-able transaction if the property is located in the Czech Republic. No transfer taxes/immovable acquisition taxes are due on the sale of real estate.

Basis of tax

Transfers of real estate after lapse of 5 years from issuance of first building permit, first approval for use or from the first use are exempt from VAT. Substantial change of the real estate restarts the five-year period. The transfers of buildings before lapse of this period are subject to 15%/21% VAT (the lower rate is applicable to transfers of residential properties).

In case of an exempt supply the seller may opt for VAT-able supply upon buyer’s agreement. Reverse charge applies in such a case (i.e. VAT is applied by the purchaser).

Companies

The same rules as for individuals apply.

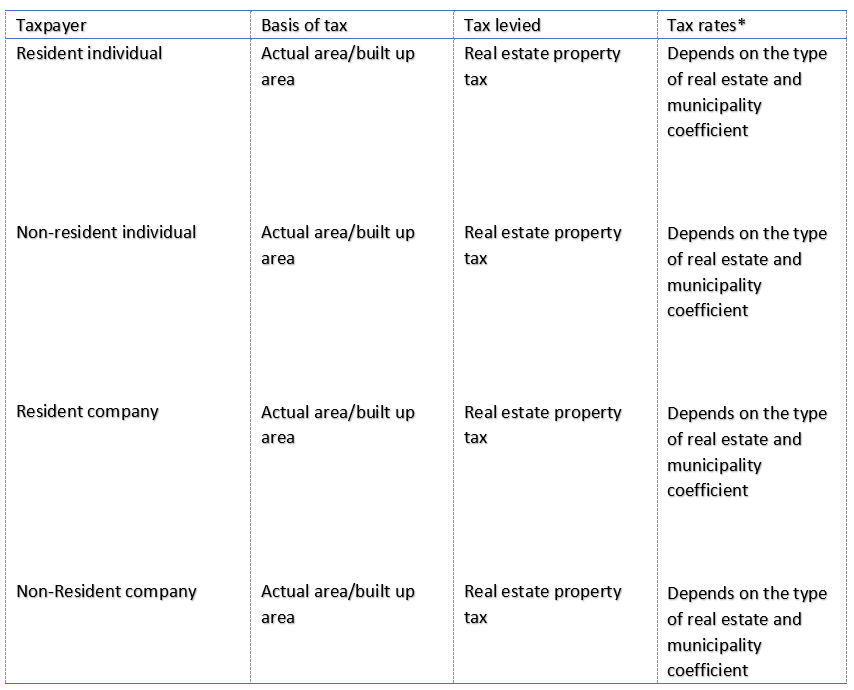

Czech Local taxes

* The municipality coefficient can be set up based on the law and decision of municipality. The coefficient can range from 1,00 to 25.

Introduction

Subject to tax is real estate located in the Czech Republic. The tax is calculated annually based on the property ownership as of 1 January of the respective year.

The tax rates depend on the purpose of usage of a real estate and the location.

Liability to tax

The owner of the real estate located in the Czech Republic is liable to tax.

Basis of tax

The real estate property tax base depends on the type of real estate and its actual area or built-up area.

The tax base for plots of arable land, gardens, and permanent grass growth etc. is the price of land determined as a multiple of the actual area of the plot in square metres and the average price per square metre of the land, as laid down in a decree.

Tax base for buildings is the built-up area in square metres or floor area in square metres for the flats or separate non-residual spaces.

Czech Net Wealth/worth taxes

There are no wealth/worth taxes in the Czech Republic.

Vehicles for Czech real estate

There is no special real estate vehicle in the Czech Republic. Various legal forms of companies listed below are used to own real estate.

Limited liability company

Czech limited liability company must include the designation “společnost s ručením omezeným” or its abbreviated form “spol. s r.o.” or “s.r.o.” in its commercial name. Limited liability company is the most frequently used vehicle for the ownership of Czech real estate. The amount of the contribution determines the share of the shareholder. Shareholders guarantees the company’s liabilities only up to the amount of outstanding deposits.

Joint stock company

Czech joint stock company must include the designation “akciová společnost” or its abbreviated form “a.s.” in its commercial name. Czech joint stock company is liable for breaches of its obligations by its entire property. Its shareholders are not liable for breaches of the company’s obligations at all. The Czech joint stock company is a widely used vehicle for the ownership of Czech real estate.

Limited partnership

Czech limited partnership must include the designation “komanditní společnost” or its abbreviated form “k.s.” in its commercial name. Czech limited partnership is established by a memorandum of association concluded between at least two persons, at least one being a general partner whose liability is unlimited, and at least one being a special partner, whose liability is limited. Profit and loss are divided between the company and the general partners.

Svěřenský fond

The ‘trust-like’ Quebec inspired version of the Anglo-Saxon Trust Fund, retaining its strong civil law nature affected by the common law institute – “Svěřenský fond”. It is attractive for both business and private use.

The main essence of the trust lays in the separation of property and the lack of legal personality, being only defined by the property itself and the afore-stated purpose. A trust is constituted through a transfer of a part (or the whole) property by the settlor (founder), administered by a trustee in favour of a beneficiary. In practice, a trust may be used to avoid rising legal restrictions normally associated with inheritance. A trust may also be used to satisfy a variety of needs in the range of business and corporate relationships, management and ownership of real estate to minimize tax burdens, as well as just to levy the burden of asset management for wealthy individuals.

Svěřenský fond is subject to corporate income at a tax rate of 19%. It is subject to the same provisions of the income tax act as other type of companies.

Czech investment funds

In the Czech Republic became available two forms of investment through the fund. They are subject to more demanding regulation and administrative duties than a regular corporate entity.

- Qualified investment fund

- Joint stock company with variable capital (SICAV)

The above-mentioned investment funds are subject to 5% corporate income tax rate if all conditions stipulated by the Czech tax law are met. The funds are subject to relatively high regulatory requirements and are supervised by the Czech National Bank.