Does the thought of the closing of accounts terrify you? Or do you handle it calmly and effortlessly thanks to well-established processes and reliable systems? Either way, we have a couple of proven practical tips that can help you manage this unpopular activity better. Despite the fact that each company is set up differently and has different internal processes, we firmly believe that the following will provide you with information that is both interesting and useful.

Our Management Consulting department is at your disposal in the first phase of the process analysis – our colleagues will be happy to review and “fine-tune” your processes and systems with you to make everything work flawlessly. The Accounting Outsourcing department will then be ready to offer you a helping hand in completing the closing of accounts and dealing with any accounting issues. Do not hesitate to contact us with any questions. We are here for you.

Closing of Accounts from the Process Perspective

In practice, we often encounter expressions such as: “OMG, the closing of accounts!” At the end of the month, you take a deep breath and prepare to spend the next four to six working days with your colleagues going through endless Excel charts, checking numbers and wishing for it to go easier and faster than the last month… And that is the best-case scenario – for many companies, the closing of accounts may take up to two weeks or even an entire month. And then it starts again, and then again. Does that sound familiar?

Maybe you could use a couple of tips and tricks to make it easier:

- Process Mapping

They say that “what is unmapped and lacks clearly defined and delegated tasks is as good as non-existent.” Therefore, many companies start correctly by mapping the processes. What is that for? Well, how else do you find the weak spots in your processes? How do you find out which tasks require the most work, and where to find all the information? How do you check whether all your data is available on a single system or if you need to transfer it needlessly between multiple systems? How do you check whether your files and documents are efficiently stored and shared, so that they are easy to navigate, and whether there are no useless backups of backups? Yes, through mapping… And that is true both for the closing of accounts and all other processes within the company. The lack of systematic plans and clearly set processes and rules may lead to a number of issues and complications. - Data Flow

Where do you store data and information? Who can access it? Can you retrieve the data from the system swiftly in the desired format and quality? How many people manage your data for it to be presentable? How long do you wait for particular information? The waiting period before data is transferred between individual departments is a common source of delays and frustration for companies. In order to close the accounting ledgers, you need to know how much revenue was generated. This requires the collection of data from sales, project management, transport and any other department with an impact on the revenues. Information on fixed assets, stock levels or other data is often required for reporting. Therefore, it pays off to map, evaluate and optimise the entire process. - Definition of Responsibilities

Does your company lay down who is responsible for a given process or part thereof? You probably know who is responsible for your closing of accounts… However, does this person know in what form and to whom to pass on the information? And is the person taking over the next activity or part of the process aware of this? If not, it may lead to needless mistakes, delays and misunderstandings. Therefore, you should not underestimate it. - Tangled Chart of Accounts

An overcomplicated chart of accounts leads to errors. There may be accountants who spend decades in a single company and who remember hundreds of different account codes and their variations, but this is not true for most people, and it doesn’t have to be. The complexity of the company’s chart of accounts naturally has its reasons – the company usually monitors the operational performance, and the accounting system is the only way to do that. If your chart of accounts is too complicated, make sure to find another way of monitoring and reporting before streamlining it. - Intercompany Accounting

Do you conduct business between several interconnected entities? In that case, you are probably no stranger to “elimination” or “consolidation”. How do you handle the mutual interactions and business deals between the individual entities and business units? Who is responsible for the closing of accounts at the level of individual entities, and who is subsequently responsible for the consolidated process of the closing of accounts? How does the communication take place? Are the processes set at the level of entities? Do you use software for intercompany transactions, or do you make do with Excel? Is it worth it to standardise the process for the closing of accounts for all your entities? Map and evaluate which entity has the best organisation of the process and use it as a template for the others. - Recording Activities

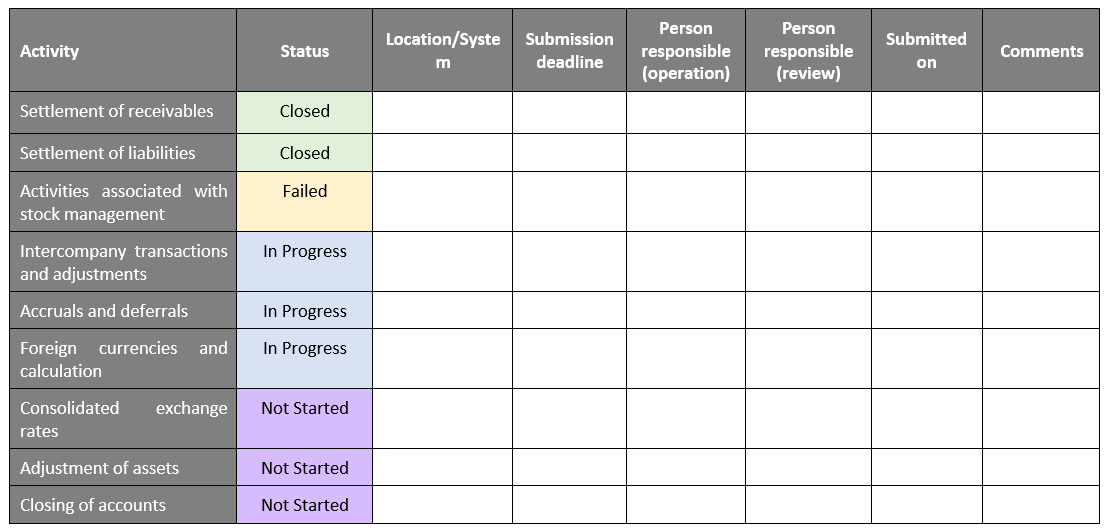

What do you think of checklists, a schedule for the closing of accounts or simple charts full of information? All of the above will help you in creating a checklist for the closing of accounts, i.e. a timetable that will show you where you are in the process at the moment, who is responsible for the individual steps, how the steps are connected, and which activities and individual sub-steps they cover and over what period of time. The checklist will facilitate your work and create a system, a definition of responsibilities and a timetable for your process of the closing of accounts. Below, you can find a model showing what a checklist for the process of the closing of accounts can look like. Each company has its own individual features, but the foundations stay the same. To create a schedule for your closing of accounts, you can use a simple Excel table which you can share through a cloud or other system solutions.

Did any of our tips pique your interest? Feel free to contact us. We are here for you. A couple of hours of work of an experienced consultant and an outside-the-box perspective will help you map and evaluate your existing systems, and together you can come up with the optimal solution that will streamline your process of preparation for the closing of accounts. Such an investment will benefit you for many years to come, and it will make the job easier for you, your colleagues and the entire team. What do you think? Is it worth it?

Closing of Accounts from the Accounting Perspective

In practice, you can find various monthly or annual processes associated with the closing of accounts. In general, the larger the company, the greater the pressure to streamline the process and the necessity of standardising the process as international companies are commonly subject to internal audits. However, even the finance directors in smaller companies have a vested interest in making their processes standardised and helping the employees who are responsible. For example, by making sure that everyone knows their responsibilities and when the individual steps of the monthly or annual closing of accounts should be performed. A good finance director knows that the better the process is set up, the faster he or she can access and check the data.

Do you feel that you could deal with financial statements more efficiently and that you could use some help? Feel free to contact our colleagues from the Process Improvement department, who will be glad to assist you!

Now is the time for annual financial statements, so let’s get started. First, we should differentiate between the financial statement and the closing of accounts. The purpose of financial statements is to prepare the accounts, which can be structured differently, depending on the size of the accounting entity. The accounts for all accounting entities include the balance sheet, profit and loss statement and notes on the financial statements. Medium and large accounting entities must also prepare a statement of cash flows and a statement of changes in equity. The closing of accounts means the closing of accounting ledgers for the relevant fiscal year (using 710 – “Profit and loss account” and 702 – “Closing balance”).

The preparation of financial statements requires several steps which need to be taken beforehand:

- Inventory-taking, accounting for differences in inventory

- Assets and liabilities which mustn’t show the closing balance as of the balance sheet date

- Stock assets and liabilities (settlement of exchange-rate gains for the calculation of assets and liabilities, settlement of balances for method B)

- Accruals and deferrals

- Estimated assets and liabilities

- Exchange rate differences

- Adjustments

- Depreciation

- Reserves

- Income tax (due, deferred)

Naturally, every experienced accountant is well versed in the above, but not everyone knows that if they write down all these items in a single document (preferably an Excel sheet), it will save them some of the work. This knowledge is gained by experience, and it can help a lot of people (not just accountants).

We will deal with the content of the individual items in future newsletters.

However, we should stop for a minute and consider the above items and whether they apply to the accounting entity. When you have accounted for all the items, or if you are certain they don’t apply to you (e.g. you have no assets or liabilities with a foreign currency balance, you have no overdue receivables, etc.), you can proceed to the preparation of financial statements. There are several ways to prepare financial statements:

- Some accounting programs can export the accounts right away

- An Excel file which can prepare financial statements

- A program that can export the statement from the turnover trial balance

- Manual calculation from the turnover trial balance and copying the numbers to a statement template

However, even the best automated process cannot deal with the fact that some assets and liabilities (usually tax assets and liabilities) can have a credit or debit balance – it is necessary to make manual corrections and match the balance sheet with the income statement for some transactions (usually, the change of balance of reserves in the balance sheet must equal the change of balance of reserves in the income statement, etc.).

When your accounts are ready, you can start with the notes on the financial statements. Since the notes complement the accounts with commentary, there are not many ways to make the work easier. You need to make sure that the notes include all the necessary information. You can use a checklist for the preparation of the notes to make sure you do not forget anything. Luckily, the requirements for the preparation of the notes do not change every year. However, you still need to keep up with the changes in legislation.

Monthly “closing of accounts” usually requires only the accounts or the turnover trial balance.

Unlike in the case of annual financial statements, aside from the notes, not all ten items listed above are required. The scope is defined in the requirements for reporting, which is a usual term used in practice for the monthly “closing of accounts”. It is prepared on a monthly or quarterly basis on the basis of the needs of the company management.

The reporting usually does not include the due or deferred tax, inventory-taking is done only for selected assets and liabilities, adjustments and reserves are not calculated, unrealised foreign exchange rate differences are not calculated, etc. As a part of the monthly or quarterly reporting, most companies are only interested in the income statement, i.e. costs and revenues, or allocation into centres or contracts. Naturally, a production company with a large inventory will have different requirements for monthly reporting than a company offering services.

Example: What should a production company monitor on a monthly basis?

Let’s say you wish to accurately list your stock level (accounting categories 11 and 12) and the materials consumed and other costs and revenues for the period to which they are materially and temporally related.

But what are you to do in a situation where the accounts are kept in accounting software and the stock-keeping is done separately in another system? The fact that the two systems are not connected makes the reporting more difficult, and you must gather the information from several sources.

The transactions related to the estimated assets and liabilities, accruals and deferrals, depreciation or unpaid receivables and liabilities in business relations can be acquired directly from the accounting program according to the maturity. Since the stock-keeping is done in a separate system, you need to download the stock level as of the end of the month and account for the closing stock of the individual stock assets and liabilities (unfinished production and finished goods). The accountant then acquires the receipts for the material from another system and matches them with the individual invoices. At this point, the accountant usually uses Excel. The accountant may use filters, formulae and contingency tables to find out, sometimes in an unnecessarily complicated way, which invoices lack their receipts (“material en route”). Alternatively, the accountant has the receipts for the materials in stock (estimates).

The above indicates that the correct setting of processes is essential for the efficient use of the time of the accountants and other persons responsible who prepare the background documents. When the accountant “puts down their pen” or turns off their computer after the preparation of the monthly closing of accounts, it is the time for controlling – every accountant’s nightmare. No matter how good the accountant is, the controller always finds something – a missing estimate, costs accounted for under a wrong contract or a wrong period, etc.

Proper monthly or quarterly reporting can save the accountant a lot of work and time (and grey hair) when processing the annual financial statements.

References