Last year, the Ministry of Finance issued Guideline GFD D – 34, “Communication on the Application of International Standards in the Taxation of Transactions between Associated Companies – Transfer Prices” as a response to the updated OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations from 2017. Guideline D – 34 provides practical recommendations for conducting comparative analyses, including recommendations on how frequently to update transfer price settings.

According to Guideline D – 34, the Ministry of Finance recommends:

- Updating the strategies for searching for comparable companies used to determine the market spread of transfer prices at least once every three years;

- Testing annually whether there have been any major changes in the profitability of comparable companies as a result of market fluctuations (e.g. a sudden surge in the price of oil or other input materials);

- In the documentation of transfer prices, regularly verifying the validity of the methods applied.

A common method to determine transfer pricing is the transactional net margin method, which e.g. takes a base corresponding to full costs and adds a profit margin derived from databases containing the financial information of independent companies (typically e.g. TP Catalyst). In our work, we often encounter the need to determine this profit margin for management services and for automotive production delivered to the distribution networks of associated foreign entities.

The typical tool used for this purpose is the interquartile range (i.e. the median 50% of the given sample) of profitability achieved by independent companies.

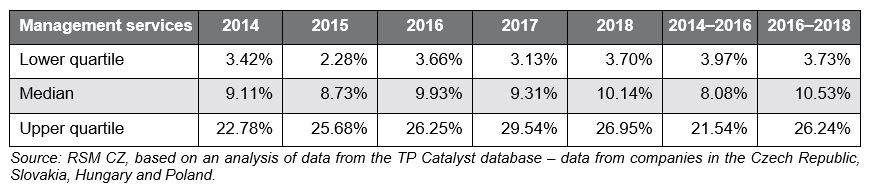

The table below shows the development of relevant statistical profit margin representatives in 2014–2018.

Data from independent management service providers shows a clear trend of a gradual increase in profitability. This development is particularly evident when the standard multi-annual averages for individual companies are used. Because of the recorded increase in the profitability of management service providers in 2014–2018, we recommend carrying out a review of the current setup of transfer prices for management services provided in a group of related entities.

The opposite trend was observed among manufacturers of parts for the automotive industry, where there has been a notable decline, particularly in the lower quartile. The decline in profitability may have been caused by the growing pressure on increasing staff expenses and the slowdown of Germany’s growth rate.

Because of the recorded decline in profit margins in 2014–2018, we recommend carrying out a review of the current setup of profit margins in automotive.

Our analyses of the development of profitability also prove that it’s useful to evaluate the parameters that influence transfer prices at regular intervals.

Are you part of a business holding? Do you need help with setting up transfer prices? We will be happy to discuss compliance with the market standard for transfer prices and any other transfer pricing issues with you.